I want to share some insight and give you a front-row seat to America’s next big shale play.

Let’s get to it…

Over the past 10 years, the U.S. has turned the ship around, quite literally.

We’ve gone from a country that was expecting to import massive amounts of oil and gas — to a country that’s sitting on massive supplies of oil and gas, right under our own soil. There’s real wealth flowing from the ground to everyday investors.

Today, I want to share what looks to be the next hot spot in this evolving story — and potentially your next chance to profit!

But first, let’s get one thing right out in the open…

Some folks are hesitant to believe America’s energy comeback. They think America’s oil boom is a flash in the pan. But these naysayers are going to miss an enormous opportunity right here in our own backyard.

With each passing day, major news sources keep producing stupendous resource estimates.

In fact, there are two stats that you should consider…

- In 2015, the U.S. is set to be the world’s leading crude oil producer, surpassing Russia and Saudi Arabia. No. 1… in the world. This is a prediction your editor Byron King made in his “Remade in America” presentation… and it’s coming true sooner than we could have imagined!

- By 2019, according to the Energy Information Administration, the U.S. will surpass its 1970s crude oil production peak. We’re going to be producing more oil than EVER here in the U.S.

Longtime readers know that I could not be more excited about this.

Indeed, next time you fill up your gas tank at the local station, don’t think about Saudi Arabia, Nigeria or Russia. Instead, think about Texas, North Dakota, Oklahoma, Louisiana and even Colorado!

These are the oil plays that are making a difference today… and will continue to do so for decades. It’s an amazing turnaround story here in the U.S.

America is set to be the world’s leading crude producer.

I’ve talked to big drillers, little drillers, service companies, rig owners… The consensus is the same…. This isn’t a flash in the pan. It’s a decades-long opportunity for America… and investors!

As America’s “second oil boom” gains even more steam, the service companies will continue to profit.

The big names — Halliburton (NYSE: HAL), Baker Hughes (NYSE: BHI) and Schlumberger (NYSE: SLB) — will all continue to do well. But then again, those names have been in the portfolio for a while, and while they’ll continue to spin cash, they’re not likely to see the biggest run-up from here.

In the service sector, there are smaller companies, too — in field services, water pumping, well maintenance. A lot of the small firms (in the right places) will do well too. I’ve been on-site with some of these players. Drill rigs are spinning, companies are hiring, morale is high — they’ve got blue skies ahead.

The oil producers in today’s shale market could do even better than the service names, though.

A lot of the American companies I follow are showing massive production increases. They’re also sporting fantastic “well pad economics” — meaning the cost of the well is a mere fraction of its lifetime value.

If you’re betting on the “right horse” in the race to produce America’s shale energy, you’ve got a great chance to multiply your money. And it should come as no surprise that when it comes to the U.S. shale race, it all comes back to location, location, location…

OK, so in the U.S., we’re seeing a huge energy renaissance. There’s oil and gas flowing from all sorts of unlikely places.

North Dakota, for instance, has the massive Bakken Shale oil field. It’s been under development for years now, and produces over 1 million barrels of oil per day. Add it all up and North Dakota accounts for one out of every 10 barrels of oil the U.S. produces — that’s amazing!

Texas is also booming. The Eagle Ford formation in South Texas popped up out of nowhere. Starting in 2007 with essentially no production, today it’s producing nearly 1.4 million barrels per day.

Again, these formations came out of nowhere! And now look at them!

Shale fields in West Texas — a prolific oil area in the 1970s — are also coming to life. The Permian Basin in West Texas is also booming with newfound shale production.

This stuff is happening all around us. And it’s all a matter of where to look for the next big find.

A little over a week ago, I was out west, looking at what could be the next big deposit here in the U.S….

It’s in Colorado, of all places.

Heh, Remember those beer commercials that said, “Tap the Rockies”? Well, we’re not far from that idea, but we’re talking about bubbling black crude oil.

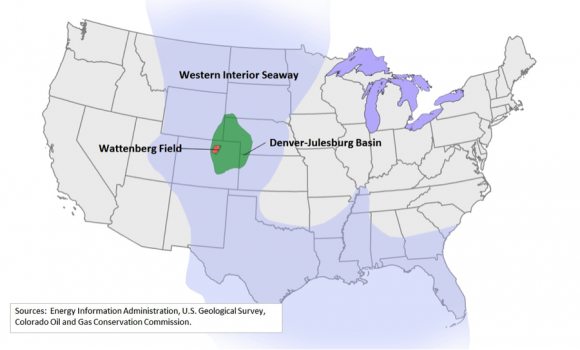

The field I’m looking at now, east of Denver, is called the Wattenberg field. It’s part of the Niobrara shale play. It’s an up-and-coming shale zone that’s not on most folks’ radar.

That’s a shame!

I’ve dubbed this area the “baby Bakken” — because within the next few years, we could see an increase in crude production similar to what we saw in North Dakota. By some estimates, Colorado could soon be the third-largest oil-producing state in the U.S.

To say that little-known companies are going to profit from this is an understatement.

It’s a huge story. All developing in our own backyard.

Keep your boots muddy,

Matt Insley

This article originally appeared here on the Daily Reckoning.